Reward credit cards are all the rage now, you can essentially get one that caters exactly for what you are looking for. Hotels, airlines, cash back, travel agents, investment bonuses; you name it, and you can likely find it. I feel like I get at least one offer a week for a new rewards credit card! Currently in my wallet I’ve got: a travel/cash back rewards (Venture), an airline card (Delta) and a hotel card (Marriott). I have a strategic reason for carrying each of them, and have found the benefits to be great! Carrying a rewards credit card is basically a game; you have to follow the rules and try not to lose before you can win big! Here are a couple of tips I’ve learned for how to win playing the credit card rewards game:

1) Watch the fees.

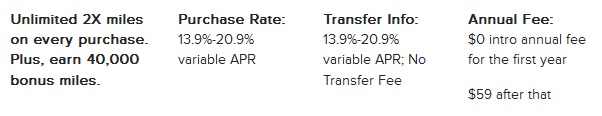

Credit card companies love hitting you with fees, its how they make some  of their money. The annual fee is the first fee you’ll likely check out. Annual fees can range from $0 to as high as $495. It’s got to be a really, really good rewards credit card (and there aren’t that many out there) to justify anything higher than $99/year. What about foreign transaction fees? If you plan to travel internationally, these fees can really add up quickly. A lot more cards are offering no foreign transaction fees. Finally, there is the all important APR, annual percentage rate, which is the interest rate you’ll have to pay on any balance you may carry. I absolutely advise against carrying a balance, as often APRs range higher in the 20-30% range.

of their money. The annual fee is the first fee you’ll likely check out. Annual fees can range from $0 to as high as $495. It’s got to be a really, really good rewards credit card (and there aren’t that many out there) to justify anything higher than $99/year. What about foreign transaction fees? If you plan to travel internationally, these fees can really add up quickly. A lot more cards are offering no foreign transaction fees. Finally, there is the all important APR, annual percentage rate, which is the interest rate you’ll have to pay on any balance you may carry. I absolutely advise against carrying a balance, as often APRs range higher in the 20-30% range.

2) Do your homework.

All reward credit cards are not created equal and your effective rewards yield can vary anywhere from 0.5% to 2.2%. What are other people saying about the rewards? How easy is it to redeem the rewards, and how easy it is to use the card (i.e. Visa vs Discover)? Is there a teaser annual fee that will go up in year two? How often do the rewards change or shift around (ala rotating categories)? As with anything in life, jumping in head first usually doesn’t work out so well.

3) Compare apples to apples.

As part of the game, you’ll earn anything from ‘points’ to ‘miles’ to ‘cash back’. How many ‘miles’ does it take to earn a free flight? How many ‘points’ will it take to stay a weekend at a hotel on the beach? Using this knowledge, translate it into dollars and cents. How much do I have to spend before earning a free stay/flight? How would this compare to a cash back card? Do a little math on your desired rewards card, and compare it to a couple others. Make sure you’re not earning tons of ‘points’ that are basically worthless!

4) Use the rewards.

What’s the point of earning things if you can’t spend them? Unlike saving for retirement, which you won’t see until you hit your upper 50s, you might as well enjoy your credit card rewards! Focus on the card that can get you what you are looking for the fastest!

5) Keep the big picture in mind.

For many of us young professionals, a good credit score can mean a lot. It can help us get approved for a car loan (although I advise paying cash!), it can help us be approved to rent an apartment, get a job or even avoid paying a deposit for our utilities. Ultimately though, the goal for many of us is home ownership. Buying a house will likely be the biggest purchase we make in our lifetime. Having a good credit score can not only mean qualifying for a $250,000 loan, but also paying a lower interest rate on the mortgage. Having too many credit cards, or not showing solid borrowing behavior (carrying too large of a balance or missing payments a couple of times) can wreck your credit and keep you r enting for much longer than you were planning!

enting for much longer than you were planning!

Credit card rewards and pretty awesome, as you’re now able to get as high as 2% in rewards. That’s like getting a 2% discount on all your purchases! I’ve done my homework, chosen the best cards, and earn almost $900 per year in cash back travel rewards. When used responsibly, credit cards can be a great way to reward yourself (or for fans of Park and Rec; Treat Yo self!)

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.