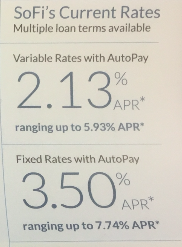

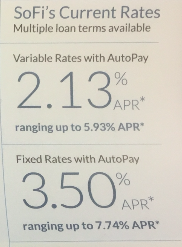

I got a question recently from a reader inquiring about a letter that they got from a company called SoFi. This letter was inviting this person to apply to refinance their student loans through SoFi, and in doing so, qualify for a super low rate, as low as 2.13%. Wow! With most student loan interest rates ranging from 6-15+%, that certainly seems like an incredible rate. As with most things that are too good to be true, I like to approach them with skepticism and do some research into them. Although several times in the past, my skepticism has proven wrong; like the time I ended up leasing an electric car or when I signed up for Lending Club. What I found was quite interesting, and I think that in the right circumstance, SoFi could certainly be a good idea if you’re looking to refi your student loans!

What is SoFi?

SoFi, or Social Finance as it’s properly known as, started back in 2011 when a couple of recent MBA grads realized that there could be interest in people with more money (alumni of their MBA school) lending money at a fair return to recent grads to help them refinance their student loans. It is a very similar concept to Lending Club; people with money lending to people without, at a rate that is lower than what a traditional bank would lend it for. By refinancing their student loans at a much lower rate, recent grads are able to save a ton on interest, and the lenders are able to receive a higher rate than from their bank on CD’s or money market accounts.

How is it different from Lending Club?

SoFi seems to much more focused on student loans, whereas Lending Club seems to have got their start focusing on credit card refinancing. Similar ideas, but with a different original target audience. As a result, SoFi is known for a very strict application process. They are quite picky with who they’ll accept, and I’ve read some complaints online about how even people with great credit scores are getting rejected. A big part of SoFi is also the community/alumni aspect. There’s almost an altruistic feeling within SoFi; the lenders and the company itself wants to see you succeed. That’s why in addition to a credit score, your degree and current employment plays a big role in getting approved. They are looking for motivated individuals that, in their eyes, will be successful and be able to pay off the loan.

Seems like a dream come true! Any downsides?

Well, as previously mentioned, it certainly can be difficult to apply and get approved. They are looking for a certain type of borrower, and not everybody will be allowed to borrow from them. That’s one way they are able to keep rates low; by having a higher quality of borrowers that will in all likelihood pay off their loans.

Additionally, and this can be important, by refinancing with a private lender (SoFi), federally subsidized borrowers will lose certain rights that come with a federal student loan. Of note, this applies to the public service forgiveness program, and the economic hardship payment plan programs. The public service forgiveness plan is the plan that allows borrowers that work in ‘public service’ type industries public lawyers, teachers or health workers to be able to have a certain percentage (ranges) of their loan forgiven after working for a certain number of years in their position. This can be certainly appealing if you’re in one of those industries and plan to remain there for a while. The economic hardship plans can be helpful for those of us that aren’t rolling in a six-figure salary to repay loans based on our income. There are certain rules that come into play, but you can minimize your payments and slow them down based on your income. If you decide to refinance with SoFi, it’d be cool to get a lower rate, but you’d be forfeiting those rights.

Can’t hurt to apply!

If you’ve got student loans with interest rates that could be lowered, I’d definitely recommend checking out SoFi. It can’t hurt to apply and see what kind of a rate you can qualify for!

While you’re searching, be sure to also apply to Earnest, which is a similar online service just like SoFi. It’s quick to apply and their rates are just as competitive, if not better than SoFi. Check them out and be sure you’re getting the best link! (Note – Earnest does sponsor YMF and I may get a referral if you choose to apply).

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Great details about refinancing student loans. I have had many friends ask me if they should refinance. I’ve heard the guidelines to qualify are pretty stringent, so I always tell them to improve their credit score prior to applying.