After a lot of advice, research and careful consideration, I finally went ahead and refinanced my house. I’d be hearing for quite some time that refinancing was a good idea and that I could save money in the long run. I will admit that it was a little confusing process; too many lenders and too many loan options. After doing some homework and taking my time through the process, I was able to refinance the house. I’m glad I did, as I’ll be able to save a lot of money in the long run!

What is refinancing?

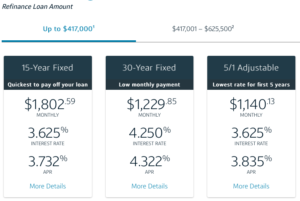

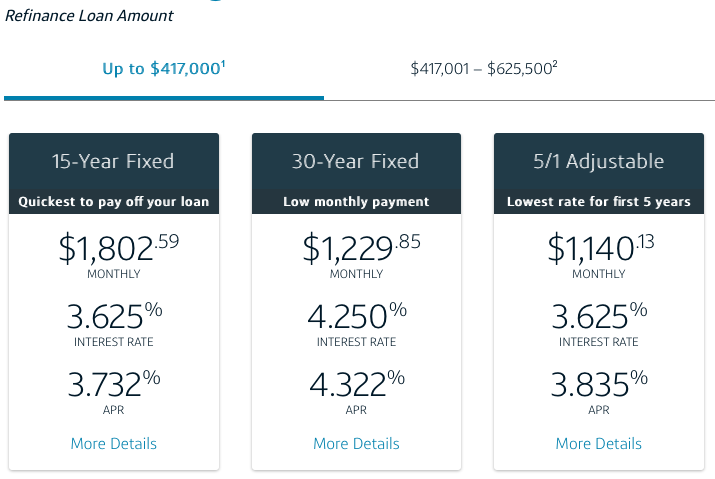

Refinancing involves working with a new lender that will give you a new loan to pay off your current mortgage. You’ll pay off your current loan and then have the new loan to start paying off. With refinancing, you can select a new time frame (i.e. go down to a 15 year loan, or go back to a 30 year loan) or select a new amount (take a loan higher than your current payoff amount to get some cash out). Refinancing comes with costs, somewhere in the range of around $3,000. This $3k can be paid upfront, or be built into the loan, so you’ll pay it off over the term of the loan. Different lenders will charge different fees, so it’s wise to shop around (including with online banks).

Why would someone refinance?

There are plenty of reasons that someone would want to refinance, so many in fact I don’t think there is a simple calculation as to whether or not you should refinance. A decision on whether or not it’s worthwhile will depend on your own situation and your financial goals. Here are a couple reasons that you could refinance:

- Lower your interest payment. Lowering your interest payment will save you money (potentially a lot) in the long run. By paying less in interest each month, you’ll be able to lower your monthly payment and pay less over the long run. When I recently refinanced, I was able to lower the interest rate (30 year loan) from 4.5% to 3.6%. That means my monthly payments went down about $200 each month, and over the life of the loan, I’ll be able to save thousands of dollars.

- Lower your monthly payment. Refinancing provides a ton of options to you, including the length of the loan. If things were really looking up (or down) for you, you could take a 30 and turn it into a 15 year loan (or vice-versa). If you are a few years into the mortgage, you could re-extend the loan back out to a 30 year loan, which would effectively lower your monthly payment. By re-extending the loan, you could easily lower your monthly payment each month, decreasing both your interest and principal payments. Often times this is helpful for people, freeing up a few hundred dollars each month that could be used for other purchases/debt payment/savings/investing items.

- Cash out some equity. As previously mentioned, refinancing can be quite flexible, allowing you to set the loan amount and repayment period at your discretion. With the loan amount, you can actually pull some equity out of your house and use that cash for other purposes. Some people might find this helpful if there was another financial area in their lives that the money could be better put to. Perhaps using some equity to borrow money at 4% would be a good use to pay off some student loans or credit card debt at a higher interest rate. In this scenario, you’re essentially getting a new loan for a higher amount then is owed, allowing you to borrow money against your house.

- Remove PMI early. Depending on the amount you put down, anything below 20% of your house’s value will be assessed a Private Mortgage Insurance monthly payment. This is a payment made by the borrower each month in the amount of around $80-120, to an entity that will insure your loan to the bank in case of loss. Once you hit 20% of the house’s value, you’ll be able to have that PMI payment removed, which will save you money each month. With a regular mortgage, you’ll likely be on track to hit the 20% at a predetermined time frame (probably around 2-3 years of your loan). Once you hit the 20% mark, you can reach out to the lender (unfortunately they don’t do it automatically for you) and they can remove PMI from your loan. Or, let’s say you’ve been paying the loan off a lot quicker or have noticed home prices in your area increasing. There could be a scenario where you house is worth more than when you bought it (hopefully is the case!) and now you have more than 20% equity in the house (any appreciation counts towards your equity). By refinancing, you can have the house appraised (costs about $400) and as long as it appraises high enough, you’ll be able to move forward without PMI.

When is it YMF approved to refinance?

Unless this is the first YMF article you’ve ever read, you’re probably familiar with my financial guidelines. I’m not a fan of dumb debt (i.e. credit cards or auto loans) and view smart debt cautiously (i.e. a home loan). Debt is fine and dandy until things head south for you financially and you’re on the hook with a loan that you can’t afford to pay. Buying a house can be a powerful builder of wealth, or it can be a financial burden on you, your family or even the entire global economy (have you seen/read The Big Short?). Investing and taking on debt should be done wisely; you should always have an emergency fund set aside and ensure that the loan payments are ‘affordable’ (i.e. not a huge portion of your take home pay). It’s obviously nice to lower your interest rates, and lowering a monthly payment is helpful because it allows me to still pay the same amount each month, but with more of it going to the principal loan value. If you’re going to cash out some equity; certainly only do it with the goal of paying off other higher interest loans. For many of us, a house is our most expensive asset and losing a house would be a devastatingly game changing event. Review your own financial situation and financial goals to determine if refinancing is right for you. As with most things in life, shop around and compare lenders!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Hey Ben, I’d note a few things. The $3,000 in costs you referenced may be a bit misleading. It’s typically a percentage of the loan amount rather than a flat amount. For example, where I work the only real fees on a refinance are an origination fee (.75%, capped at $1,500, can be financed with loan) and an appraisal fee ($330). You can definitely spend less than $3,000 in fees.

Secondly, not all lenders require PMI, even if the owner has less than 20% equity.

Just wanted to point those things out because I enjoy your blog!