We’re all in different stages of financial health, but to get a ‘passing grade’ from YoungMoneyFinance; young professionals should be sure they meet the following minimum requirements with their finances:

1) Make sure you have at least $1,000 set aside for emergencies.

Commonly called an “emergency fund”, this will help you sleep better at night knowing that in the case of an emergency that you’ll be able to weather the storm. Let’s hope that you don’t find yourself facing a financial emergency but it’s better to play it safe and ensure you’ll be prepared. Whether it’s unexpected car repairs, having your car stolen (true story), facing a medical need, losing your job or any other type of an emergency, an emergency fund will ensure you’ll be prepared. Keep this account separate from your other bank accounts (and not in cash like a friend asked me recently) and keep it in something liquid, like a savings account. It’d be better to have 3-6 months stocked away, but $1K should be the minimum.

2) Make sure you’re saving for retirement – at least up to the match that your company offers.

A lot of companies will offer a 401(k) match – meaning they’ll give you up to a certain percentage (2-5% is common), as long as you contribute that same amount. If you’re not contributing as much as the match – you’re basically throwing away free money. You may be new to the blog, but throwing away free money certainly isn’t YMF approved. Ideally you’ll be saving 15% for your retirement (admittedly this isn’t an easy task) but saving at least the match should be happening in your 401(k) plan.

3) Be aggressive about getting out of debt.

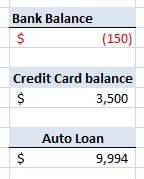

Notice I didn’t say “be debt free” or “be in stage 4 of a debt snowball”, I simply said be aggressive about it. Now I’m not necessarily talking about business debt (although I might make an argument there as well), I’m talking about personal debt. Although I’d consider all debt bad, I put student loans and mortgage payments into the category of “less bad debt”, but everything else (credit cards, car payments, personal loans) into the category of “bad debt”. Debts are liabilities that are holding you back. Debts are dangerous because they often become a habit, and often get out of control. Interest (a very powerful force for good or evil) can get out of hand if you’re not being aggressive with your debt – leaving you owing more and more to your loans. Learn to say ‘no’ to a few more things in your life right now and get aggressive about getting out of debt. Being debt free comes with so much financial freedom, and the real ability to build wealth (responsibly).

4) Have a credit card that at least pays 1.5% cash back.

*NOTE THIS POINT ASSUMES YOU ARE RESPONSIBLE WITH YOUR CREDIT CARD USAGE…I.E. PAYING OFF IN FULL EACH MONTH. Credit cards can be a powerful tool that can prove useful, or can prove to be a curse that gets you in a vicious debt cycle. This point assumes you’re using it for good and if so, credit cards can be very rewarding. I for instance, earn about $900 each year in rewards, allowing me to go on fun vacations. At a base level you should be earning 1.5% cash back. Not points, not gimmicks but cash. The Capital One Quicksilver card is a great card for beginners and will give you 1.5% cash back on all purchases. Their rewards are super easy to redeem and it’s a great way to save up for really whatever you’d like! There are certainly more fancy advanced cards out there but at a minimum 1.5% should be your baseline.

5) Make sure you’re earning 1% on your savings account.

Traditional banks today pay embarrassingly low interest rates for savings accounts. If your money is just sitting there (safely!), you might as well earn all you can from it. Check out online banks like: Ally, American Express or Capital One and pick your favorite. These are all banks I’ve either used or have had friends use and are highly recommended. It’s possible that you’ll be earning 10x from them compared to what your traditional bank pays – and with no fees! Now you don’t completely have to leave your current bank, just open up a savings account online and start saving your money there instead.

6) Have a budget.

Although not impossible, it’s difficult to fully gauge your financial standing and make improvements without a budget. (I suppose you could just make sure you spend less then you make and save the rest each month). A budget gives you the overall picture of your financial standing, allows you to set and track goals, and allows you to identify areas for improvement (‘wow I spend how much at restaurants?’). There are many budgeting tools out there, ranging from the low tech (basic spreadsheet) or the high tech (apps or websites like Mint.com). A couple of recommendations I have: there’s the official YMF budget spreadsheet located here on the blog, Mint.com (just make sure you’re actively reviewing it) or Dave Ramsey’s app (Every dollar). Remember though that a budget is only helpful if you review and gain insight from it, otherwise they’re just numbers on a page/screen!

How did you stack up? Maybe you’re a rockstar and got 6/6 – if so, congrats! You’ve received a passing grade from YMF on your financial situation. Less than 6/6? There’s definitely some room for improvement then, as these are the ‘passing grade’ criteria; not even getting into some more advanced topics! If you find yourself with less than 6/6 categories; consider making some changes in your life! All of them are goals that you can set and get working on right away. Get to it! Also – I do from time to time offer financial consultations with readers, nothing fancy but a Q&A with me and a chance for me to make recommendations. Give me a shout via the Contact page and I’d love to connect!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.