I don’t know about you, but my life has felt really busy lately. As some of you might know, I recently switched jobs, and have been slowly getting into the groove at this new company. This new role requires a bit more travel and as such, I’ve just felt busy! It’s definitely been a good busy, but often the last thing I want to do is think about my finances. I’m sure many of you are in the same boat. It’s not that managing money takes a significant amount of time; it’s just that I don’t seem to have the motivation to! In order to have the confidence that you’re managing your money well without spending a significant amount of time, follow these three tips!

Have a framework setup

Do you know how much you earn? Do you know how much you bring home each week in your paycheck? What about your spending? How much is rent, phone, groceries, gas and car insurance? Knowing these basic numbers will help you set a good framework to balance your spending. Have a general budget setup for yourself and you’ll know if you should buy that new purse or go out to eat with friends tonight. It’ll also allow you to prioritize and make room for saving, whether in the stock market or in a savings account. Setting up boundaries will allow you to not have to monitor your budget all the time, but will let you know when you’re getting close to going out of bounds.![]()

Automate

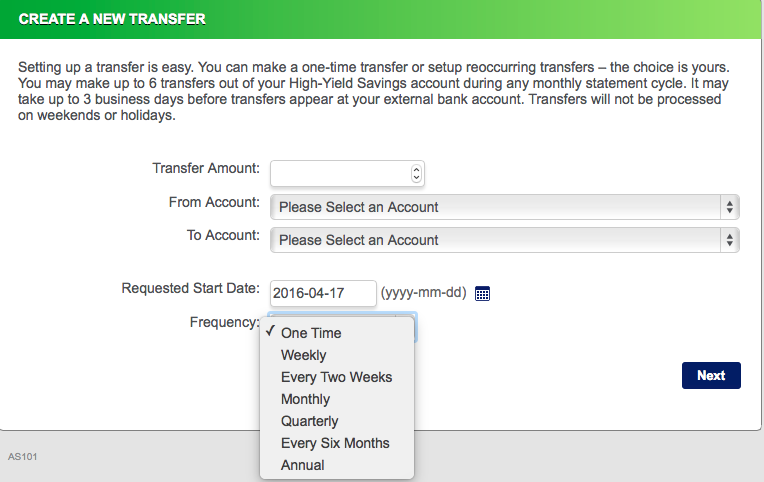

So you’ve got a good framework setup for yourself, you know that you make $X each month and have $X to spend on each month. Hopefully you’ve left some room in your budget for saving. Financial experts recommend savings 15% for retirement, and also setting aside some extra money into a savings account, for that new car, a down payment on a house, or maybe when it’s time to go back to school. The easiest way to manage this saving and to ensure that it happens is to automate it. Most banks and retirement brokers have tools that will allow you to set up recurring, automated transactions. Get paid on the 15th and 30th of each month? How about having money go into your savings account on the 16th and 31st (or 1st)? Go ahead and take “move money into savings account” off your to-do list. By automating, you won’t have to worry and you’ll slowly watch your bank account grow! Same principle holds true for expenses, many utilities, loan payments and other expenses can be automated too. Why not go ahead and have one less thing to worry about and always ensure your bills are paid on time?

Periodic check-ins

I understand that most people don’t have the passion for budgeting that I do, and honestly I’d probably recommend not checking as often as I do. After follow steps #1 and #2, you’ll be in a pretty good spot. Your bills will be paid; your savings account/retirement fund will be growing and you’ll hopefully have the discipline that comes with a budget to spend less than you make each month. I still recommend checking in on your finances and budget every now and again. Re-evaluate your spending and income and look for ways to cut back. Perhaps you got a new eco-friendly car that doesn’t require as much gas. Maybe you’ve taken up cooking and don’t go out to eat as often. Taking a periodic look at your budget will ensure that your budget is best fitting your financial needs. I’d recommend taking a quick glance at your bank account and credit card statement at least once a week, and doing a more thorough review more like once a month.

Most of us are super busy in our personal and professional lives. Unfortunately it does take some time and work to stay on top of your finances, but with the help of automation and having a good budget, it’ll make things a lot easier for you!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.