Dave Ramsey has famously said that financial success is 20% head knowledge and 80% behavior. Hopefully this blog has provided you with plenty of head knowledge through the articles, unfortunately there’s only so much I can do to influence your behavior. Fortunately for you, I really believe that if you can develop the self-control with your finances, you’ll end up being much more than ok! Let’s walk through the three main areas by which you’ll need to exhibit good behavior!

Expenses

Probably one of the most obvious ways that self-discipline comes into play is by controlling your expenses. Whether it’s upsizing at Wendy’s, heading out for drinks with friends or going on a vacation, expenses are often what breaks people’s budgets and keep them from financial freedom. I’ve like to say that there are only two ways to improve your financial situation: increasing your income, or decreasing your expenses. One of these is much easier to do for most of us, and so controlling expenses is absolutely crucial. Having the self-discipline to not only have, but also to stick to a budget will help control your expenses. Having a budget will let you know when you can reasonably afford to say ‘yes’ and when you should say ‘no’. It’s the ability and the habit of saying ‘no’ that will set you up for financial success.

Savings

There’s an old saying that reminds us to ‘pay ourselves first’ which basically means that the first transaction out of your bank account after payday should be a transfer into a savings account. Saving is a crucial piece of becoming financially successful. How many rich people do you know that don’t have any savings? For many of us, we unfortunately pay ourselves last. We get paid, pay the rent, utilities, credit card bill, go out several times and then at month’s end if there’s anything left, save. If you want to reverse your financial woes, learn to have the discipline to save. Commit to saving a certain percentage each month (10% would be a good place to start) and be disciplined enough to save that amount. Come to view your savings account as off limits and if at month’s end you’re out of money, well tough luck! Set up automatic transfers straight into a savings account the day or two after getting paid. It’s incredible what we can automate these days, so definitely automate saving!

Investing

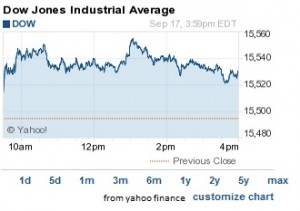

For many of us, investing is either something that absolutely terrifies us or something that we’ll do when we’re older. Learn the importance and beauty of compounding interest if you need a refresher. Investing in your retirement at a younger age will make up for years of saving extra when you’re older. Commit to investing ideally 15% (start smaller if you can’t afford 15% right now) of your paycheck, and participate in your company’s 401(k). If you don’t have access to a 401(k), open an IRA (individual retirement account) which virtually anyone can do, even online! Learn to have the discipline to invest on good days, and on bad days. So many of us stop investing when the market is down and get back into it when the market is up, which basically equates to selling low while buying high. Investing is a long game, and you’ll certainly experience good and bad days in the stock market. I invest just under 15% of every paycheck in my 401(k), regardless of whether the market is up or down. Get in a habit of moving that money into an investing account, and then investing. If you don’t know where to start, pick a good index fund, which invests in the market as a whole. Schwab has a good one, ticker SWTSX and Vanguard has a good one too, VTSMX.

Being disciplined when it comes to your finances is probably the best indicator of your long-term financial success. Having a degree in finance certainly won’t get you there; it’s got to be a behavior issue. Get in the habit of making smart choices with your money in the 3 above areas, and set yourself on the right track!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.