The rational behind this post came about after the 3rd person asked me for my thoughts on bitcoin in the same weekend. Although I’ll speak to bitcoin in this article, I won’t go into great detail about it. For more info check out my article “What is bitcoin”. I’d like to propose that while the bulk of your savings and investing should be in safe, diversified investments that potentially a part of it could be in more risky investments, in an attempt to give into the gambling urge while not risking more than a small, small portion of your overall portfolio.

Stick to the code

I’m a big believer in sticking to the 75% rule – saving 25% and living off of the other 75%. Of that 25%, I recommend dividing it up into 4 buckets – retirement, general saving, paying down debt and charitable giving. The idea is to also make that 25% a priority, and automate that saving as much as possible. When the money goes into retirement and savings, I strongly advise putting your money into index funds (I do!). Index funds are a low cost way to diversify your money into the stock market, and typically earning a return that matches the market, without paying high fees to do so. Of that investing/saving money, I would recommend putting 95% of that into index funds and then establishing a small (5% or less) “mad money” account in which you allow yourself to get fancy, risky and have a little fun with your investment. Jim Cramer puts it best saying “put $10,000 in an index fund and then establish a small ‘mad money’ fund”.

Why it’s ok, and why you should

Part of what makes gambling fun is the chance of earning a big return. People pay the lottery for the same reason others gamble in casinos, buy penny stocks or as of late, ‘invest’ in cryptocurrencies (like Bitcoin). It’s almost an adrenaline rush, knowing that your taking a risk on something that could pay off big. Something about the element of chance – knowing it’s not likely but that it could be big. We all hear (and read) stories of lottery winners, sometimes even from the town we’re in. I’m sure we all have friends that have gotten lucky with a stock, watching a $100 stock double in a few weeks to $200. Or perhaps (true story), the buddy of mine that turned $80,000 of bitcoin/ethereum (another cryptocurrency) into over $1M. Yeah, a story like that really gets people excited.

Gambling is almost a natural human instinct, we like taking risks for the chance at something more. So, why I’m allowing (I shudder to encourage) gambling is because I understand that we are all going to have that desire in us, and to completely fight it would be wrong. Rather than bottle it all up which might lead to a breakdown one day – I think it’s better to give in to that desire – in a very controlled manner. Of that 25% that your save/invest, only 5% of that amount (so 1.25% of your monthly earning) should go into the Mad Money account. By gambling a little, I trust that you’ll be responsible and not put more than 5% of your investing money in that account, and that you’ll be responsible and not feel the urge to do anything with your 95% real investing fund.

What to gamble in

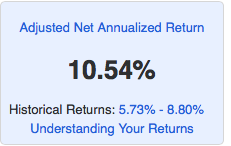

Ohh! The options are endless. For most people, this will probably involve buying into stocks. Perhaps you enjoy following the stock market and are always getting “hot tips” – a buddy of mine just threw some mad money into an technology stock that sells wireless chargers for phones that just won FCC approval. It was up like 50% in one day and he jumped in. It went up another 25% (super fun!) before crashing down a few days later. A fun ride! For me – I put some of my mad money in Lending Club, and lent my money out in $25 increments to folks looking for loans. It turned out not being as lucrative as I had thought – but hey that’s the point of taking more risks with just my mad money. Or perhaps you may be like family members that buy a lottery ticket twice a week (whoa – I should probably clarify that lottery tickets are not even a gamble and that aren’t a good use of even mad money). As of late, cryptocurrencies are the hot new things to talk about. Sure I’ve been following bitcoin since is was at like $200…and now it’s $17,000. Do I regret not investing then? Haha, certainly a bit. But had I invested, I would have just put like $200 in…sticking to the 5% limit rule for my mad money. I personally own a handful of individual stocks that I’ve had mixed success with. I’ll admit that I feel the urge to take more risks with my money (i.e. individual stocks), and yes I’m strongly considering buying some bitcoin but I’m able to feel good about doing so because I know that 95% of my investment money is safe in index funds.

Summary – in case you’re still unsure

I am not encouraging you to buy lottery tickets or go to casinos and drop your hard earned cash. Both are rigged in such a way that the house wins and you lose almost all of the time. I am allowing you to occasionally buy an individual stock or perhaps invest in another currency (maaayyybee bitcoin…just know it’s SUPER risky). If I thought bitcoin was risky when 1 bitcoin = $250 imagine how much riskier it is at $17,000! This mad money fund should consist of no more than 5% of your investing money – which consists of 25% of your monthly earning. I’m really nervous even posting this article – please be responsible!!

Ok, so a little more about bitcoin

For those of you really curious, I will explain how to invest in bitcoin, only because I’ve been asked several times and if you’re going to try – I’d rather you listen to me and follow my instructions. For full transparency, I do not own any bitcoin or other cyrptocurrencies like it. I have however opened an account with an online trading platform and may put $100 in. I’m super torn – on the one hand I think they are the interesting and promising pieces of technologies. On the other hand, they are essentially just a network of computers all running the same program to digitally record transactions. There is nothing special (or anything or worth) with bitcoin, litecoin or ethereum. They just happen to be popular right now and keep running up in price because everyone is talking about them. Technically they are a currency that people use to buy and sell, but right now why would you buy/sell if your currency is shooting up? Sooner or later people will realize that the currency has no value other than the ability to trade and the currency likely will fall. Although, I’ve been saying that since it’s at $250, so what do I know? Ok, rant over. Should you invest in bitcoin? Absolutely not. Should you gamble in bitcoin? No. But I understand and in the previous article told you that it’s ok to have a little fun/play money in certain investments and if you’re set on cryptocurrencies then so be it.

To purchase (I really don’t like the word investing…) bitcoin/litecoin/ethereum (the most popular ones), you’ll need a digital wallet. For those of us (myself included) not technically savvy, the easiest (and arguably safer?) manner to do so is with Coinbase. They’re a startup now grown to 13 million users and have some big name venture backers behind them. I’d argue they might be the leader right now and definitely an easy place to start. For full disclosure, I’m attaching a referral link that will give both of us $10 worth of bitcoin if you signup and invest $100. So full disclosure on my motives but please understand I’m not encouraging more than $100 and only if you follow the above rules!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.