Did you know that April is financial literacy month? It’s basically like the super bowl for personal finance bloggers like myself. Typically, this month focuses on educating, reminding, and reviewing the basics of personal finance. What is interest, what is debt, how do you earn money, how do you spend money, all very important things. I’d like to do something similar, but with a focus on young professionals. We’re not in grade school learning how to calculate simple interest on a savings account nor are we in middle school learning how to balance our checkbook. We’re out of college, working, paying off debt, saving for a house and trying to save for retirement. What are the basics of financial literacy for young professionals?![]()

1.) It’s never going to be easier.

As difficult as it may feel now, making that young professional income (i.e. not that much but with plans for it to increase with raises), we’re in a relatively great spot financially. Many of us are single and don’t have a family to provide for. Those of us that are married are likely DINKs, (dual income no kids), and are enjoying that dual paycheck lifestyle. With this period of relatively low responsibilities (no house, no kid), it’s a great time for us to take advantage and put our money to work for us. That student loan debt? Might as well start paying it off. Saving for retirement? Go ahead and max it out ($18K annually). It’s a great time to get out of debt and focus on investing. That’s my personal philosophy right now. Although one day Mrs. Money Finance and I would like to have kids, we don’t yet and are trying to focus on putting away as much money as we can. I fully realize that as I get older that I’ll have more financial responsibilities and understand that I won’t be able to save 40% of my paycheck each month. But, until that day comes, I’ll continue to save 40% and hopefully that’ll pay off long term down the road!

As much fun and carefree as you’d like to live – realize that as a young professional, it’ll likely never be this easy to put aside so much for saving/investments and to get out of debt. Take advantage while it’s easy!

2.) The power of compound interest

Whether it was or wasn’t Albert Einstein who said compound interest is the 8th wonder of the world, compound interest has a profound affect on each of our lives. Compound interest (in the spirit of financial literacy), is the feature of how interest earned in one period is treated as principal in the next period, thus earning more interest. Simple interest of 10% would be $10 on $100, and another $10, and another $10. Compound interest allows that $10 to go into the $100 pot and to calculate 10% on $110, instead of $100. Sure the $11 instead of $10 isn’t that much more, but over time, and on bigger balances, it can (and does) add up, big time. On the plus side, this bodes well for our investments; both our savings account and investment (i.e. retirement) accounts. By ‘reinvesting’ our interest/divdends, we’re able to over time, earn more and more on our money. On the con side, compound interest can also work against you – a la debt (i.e. credit cards). It’s awfully easy to rack up some charges on a credit card and pay them over time, but the same principal of compound interest applies. If you aren’t careful and staying on top of paying off your debt, it’ll grow over time!

Compound interest is a powerful force that can greatly benefit you, or greatly harm you! Take care and make sure it benefits you instead of hurting you – minimize your debt and maximize your investments!

3.) Have a budget.

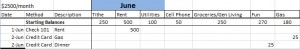

If you don’t know where you’re going in life, you’ll for sure never get there. If you don’t keep tabs on your finances, your finances will find a way of telling you where they’re going. Having a budget is a simple method to make sure you have goals for your money, and stick to them. A budget allows you to tell your paycheck that you want to put aside $250 each month into savings, and another $750 for student loans. It also reminds Friday night young professional that you are putting aside $1,000 this month and that you probably should skip the dessert at dinner. A budget doesn’t have to be fancy or extravagant, mine is an excel spreadsheet. There are lots of great tools out there like Mint.com, or a budgeting tool offered through your bank’s website. Find a solution that works for you and stick to it. Figure out how you want to spend your money and commit to that plan! Give yourself grace when you overspend in one area one month and save less, and try to hit it harder the next month.

Having a budget is the only surefire way to both set goals and make sure you stick to them.

4.) Don’t spend more than you make.

As basic and fundamental as it sounds, this is actually a tough one and gets many folks into a lot of financial trouble. Spending more than you make means you likely don’t have a budget, or aren’t good at sticking to it. Spending more than you make means you’ll have to dip into savings, or go into debt, and that’ll put you on the wrong side of the compound interest formula. A lot of young professionals struggle with this – and I get it. We all have social lives, and those social lives are sometimes demanding. It’s hard to say “no” to something fun, something you want, or even something you really think you need. A lot of the excuses center around how folks just aren’t’ earning enough right now, but they expect that to change in the future and that in the future they’ll do better. The unfortunate reality is that if you can’t manage your money when you only have a little bit of it, then you won’t be able to manage your money when you have more of it. Our lifestyles tend to grow in relation to our paychecks, and the more we earn the more we feel the need to spend. I’m all for having a good time, eating out, buying new clothes, going on nice vacations; as long as we’re not spending more than we make. Learn to live with what you have and if that’s not enough – find ways to increase your income. Whether it’s a side hustle, a second job, going back to school, or asking for a raise at work – either increase your income or decrease your expenses!

Not spending more than you make each is a requirement to keep you in good financial health.

5.) Live your own life.

Each of us is different, and each of us is unique. We each have our own goals, priorities, dreams and passions. However, somewhere in the mix things get shuffled around, and we end up trying to live someone else’s life. Whether it’s trying to keep up with the Jones’ (i.e. our peers), or keeping up with our Facebook/Instagram friends, we often end up spending our time, energy and money in things that don’t bring us happiness. As Will Rogers put it, “Too many people spend money they haven’t earned to buy things they don’t want to impress people they don’t like”. We feel social pressure to live our lives in a certain way, and that often gets us into financial trouble.

Figure out what’s important to you and let your spending habits reflect those things!

Curious to learn more? Check out my comprehensive guide “Personal Finance 101” to learn more of what’s important with personal finances.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.