Ideally, we would know how to spend and save money wisely from a young age. If you have never been taught good money habits, or have picked up some bad ones over the years, you may find yourself struggling to make ends meet, or in increasing levels of debt.

The importance of being responsible with money can never be stressed enough. It can make such a difference, especially if you are the victim of an unforeseen circumstance such as your car needing repairs or being unable to work due to sustaining an injury – if this sounds familiar, click the link for more info from a list of personal injury lawyers. I like to say that it’s not a matter of if you’ll ned an emergency fund, and instead of a matter of when you’ll need it.

To get better at managing money you’ll need better financial habits. Financial habits, just like other habits we have in our lives take time and effort to develop. Nothing comes easy and to develop habits, it’ll take some work! Let’s explore 3 crucial habits to help you get better at managing your money.

Budget Your Money

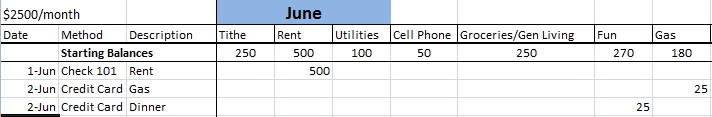

In my opinion, the number 1 indicator of someone being financially healthy is whether or not they have a budget. Creating a budget can help you track what money you have coming in, and where it is all going. This can allow you to view any unnecessary spends, things you don’t use, and expenses that cannot be removed, such as rent. You’ll likely be surprised at how you spend your money, and a budget helps you be more aware of it.

You can use your budget to plan for the upcoming months, including money you might need for special occasions such as birthdays or Christmas. This will also show you how much money you can have for fun purchases, once money has been allocated and put aside for savings, of course. Budgets allow you to set goals, and work to stick to them!

Automate Your Savings

If you have to physically transfer money into a savings account, it can be very tempting not to. Likewise, if your savings are with the same bank, you may also be tempted to trickle money back into your main bank account for unnecessary purchases. By using a different bank and automating the transfer, you can help yourself to reduce the risk of not saving occurring. After a few months, you may even forget that this is happening, as you will become used to that money not being in your main account to start with.

It’s easy to setup automatic transfers within your bank. I recommend setting these up the day or two after getting paid – that way the paycheck clears and you’ll move the money before you’re tempted to spend it elsewhere!

Allow Some Freedom

While these healthy habits are good, you do need to allow yourself some fun. The same with dieting or even working, if you try to limit yourself too much, you may end up failing altogether. To overcome this, allow yourself a small portion of spending money each month that you can do what you like with. Whether this is a new video game, a meal out, or drinks at the bar, that is for you to choose, however, you must stick to the limit and, once it’s gone, wait for your next month’s ‘allowance’.

Summary

Having healthier money habits can really help you to manage your finances better and plan for any costly circumstances. The younger you ingrain these habits, the more you will be able to make the most of both your money and time. This can also help you to work towards larger goals, such as paying for an extravagant vacation, new car, or even towards the cost of buying your own home!

Disclosure: Some links are affiliate links that earn me a commission.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.