I always say that if you want to improve your financial standing you need to either increase your income or decrease your expenses. Managing expenses is probably easier to do. When it comes to managing your expenses, the key is being organized and disciplined. So many people neglect this area of their finances because they are overwhelmed with it or just don’t know where to start. However, when you have a system in place that works for you, it can be surprisingly easy and rewarding to manage your money. Here are a few tips to get you started:

1. Keep track of your spending

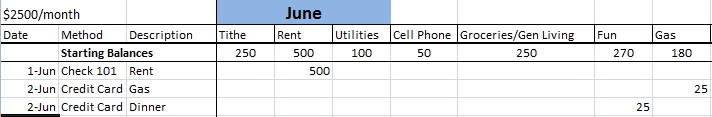

This may seem like an obvious first step, but so many people don’t do it. You can’t make informed decisions about your spending habits if you don’t know where your money is going. There are a number of ways to track your spending, from using a budgeting app to simply writing down what you spend each day. Make it a habit to check in with your spending at least once a week so you can make adjustments as needed.

2. Make a budget and stick to it

Once you know where your money is going, it’s time to set some limits. A budget will help you make spending decisions in advance and keep you accountable. Make sure to include both essential and non-essential expenses in your budget so you have a realistic picture of your spending. Of course, your budget is not set in stone. You’ll have to make adjustments often but, as much as possible, try to stick to it. This will help you curb impulse spending and make the most of your money.

3. Automate your finances

One of the best ways to stay on top of your expenses is to automate as much as possible. You can set up automatic payments for your bills, savings, and investments on digital banking apps so you don’t have to think about it. This will help you avoid late fees and make sure your bills are always paid on time. You can also set up alerts for when your account balance gets low so you can transfer money as needed.

4. Set financial goals

What do you want to achieve with your money? Setting financial goals will help you stay focused and motivated to stick to your budget. Do you want to save up for a down payment on a house? Pay off your student loans? Build up your emergency fund? Having specific goals in mind will make it easier to stay on track. A lot of people find it helpful to break down their goals into smaller, more manageable pieces. For example, if you want to save $1,000 for a vacation, you can break that down into saving $83 per month.

5. Cut back on unnecessary expenses

One of the easiest ways to save money is to cut back on unnecessary expenses. This could mean anything from eating out less often or canceling that gym membership you are not using. Take a close look at your spending and see where you can cut back. Even small changes can make a big difference in your overall expenses.

6. Shop around for better deals

You can save a lot of money by simply shopping around for better deals. When it comes to things like insurance, phone plans, and loans, it pays to compare your options and see if you can get a better deal. There are also a number of ways to save on everyday expenses, like groceries and gas. Take some time to research the best deals and you could end up saving a lot of money each year.

7. Make a plan for unexpected expenses

No matter how well you budget, there will always be unexpected expenses. Whether it’s a car repair or a medical bill, these expenses can throw your finances off course if you’re not prepared. One way to avoid this is to create an emergency fund that you can tap into when these unexpected expenses come up. You can start small by setting aside $50 from each paycheck, or you can make a bigger dent by setting aside 10% of your income.

8. Invest in yourself

Lastly, don’t forget to invest in yourself. This could mean anything from taking a financial planning course to hiring a professional to help you with your taxes. The more you know about personal finance, the better equipped you will be to make smart money decisions. And, as always, if you have any questions, don’t hesitate to ask a financial advisor for help.

With these tips, you can take control of your expenses and start saving money. Just remember to be patient, stay disciplined, and focus on your long-term goals. With a little effort, you can manage your finances and achieve your financial goals.

Disclosure: Some links will earn me a commission.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.