Hi! I’ve made a big jump in 2023 and am now on Instagram! Be sure to follow along here.

When I bring up the word budget, what comes to mind? Hopefully it’s not an “ugh…” or a “sigh”, but for many young professionals this is the case! I’m often asked if there is one piece of advice I would give young professionals and it’s always “get and maintain a budget”! I’ll talk a little bit about why having a budget is so important, why it shouldn’t be that hard and then get into answering the question of how often you should budget.

Why budgeting is so important

If you don’t have a good plan for where you’re going in life, you’re probably not going to end up where you’d like to be. A budget isn’t meant to be this tool that ruthlessly dictates your life and makes you say ‘no’ to everything, it’s simply a tool to track your income and your spending.

You get paid I’m guessing at some regularly interval; maybe it’s twice a month or once a month or weekly. You also likely have lots of spending; bills, eating out, gas, clothes, shopping, vacations, movies etc. How do you know if you’re spending less than you’re making each month? Outside of that, you also probably have a saving/investing goal in mind; maybe it’s just an idea right now or maybe you do have a percentage or dollar amount goal. How do you know if you have enough left over after spending to move into a savings account?

You could hope for the best, but hope is not a worthwhile strategy. You could cross your fingers and hope you’ve still got money in the bank at the end of the month. The funny thing about money is that if you aren’t very focused and firm with it, it’ll find a way to get spent. That last minute invite will inevitably turn into a yes, staying out a little later for another round or taking advantage of that sale will definitely happen.

Or, you could get a budget, which tracks the money coming in vs. the money going out and lets you keep tabs on your saving/investing goals. That’s all a budget is. It doesn’t say ‘no’, it just lets you know that if you say yes to something you might be trading that yes for something else you might have liked to buy or save!

Make budgeting easy

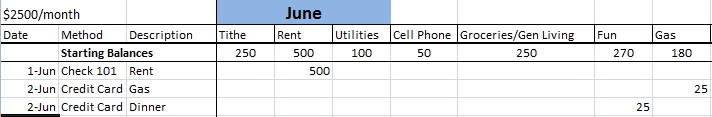

There are lots of great budgeting tools. Back in the day it was Mint.com and then EveryDollar came out and now it seems like most banks offer their own budgeting tools. Or you could go old school like me and use a spreadsheet (my template can be found and downloaded here).

There is no ‘best’ budgeting tool out there – it’s simply finding the one that works for you and the one you can easily stick with. Give a few budgeting tools a try and see how you like it. If you find it not helpful or you’re not sticking with it, switch to another tool. The important thing is consistency with a budget – the tool that’ll help you meet your financial goals! A lot of high tech tools basically do it all for you – they can import your financial transactions and give you a good idea of where you stand. Budgeting isn’t meant to be hard! The hard part of learning to say ‘no’ in an attempt to help you say ‘yes’ to meeting your goals.

How often should you budget?

I’ll admit that there was a time in my life I budgeted almost daily. Haha, I wasn’t PapaMoneyFinance with kiddos running around and I had more time on my hands. So weirdly I chose to spend more time than I probably should have tracking my financial progress. Nowadays I’d say I budget weekly. It’s easy with credit cards to log in and see your spending, or maybe the budget tool pulls it in automatically for you. With my old school method I typically go in once or twice a week and update it. I like seeing how we’re doing for the month and can be a little more proactive if I need to be on being more strategic with our spending.

For you it might be different but I do still think I’d recommend a weekly budgeting session. I’m guessing your budget is on a monthly basis and if you budgeted monthly you really wouldn’t have time to course correct if you needed to. Budgeting weekly allows you to be more proactive and make changes if you need to. Perhaps you’ve eaten out a time or two more and can plan more meals to make at home next week. Perhaps you already saw a movie and need to politely decline next time. Checking a bit more frequently will allow you to do so!

TLDR

A budget is probably one of the most important financial tools out there and is a great planning tool that helps you achieve your financial goals! Try to find the budgeting tool that works best for you and try to check on it / update it weekly!

What about you? What does budgeting look like for you?

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.