Budgeting almost has a bad connotation today when you bring it up, people often roll their eyes or shrug their shoulders at it. Budgeting is so crucial to managing our finances, which is a goal for many of us but often we give up after unsuccessfully trying to budget. Although it’s feasible to manage your finances without one, I’m convinced that a budget is really required to be successful with your finances. In an effort to make it less scary, let’s dive in to how I budget which is very simple and everyone can do it.

I will call out that my method is a little simplistic, there are lots of good budgeting tools out there today, Mint, and EveryDollar are two of my favorites. I personally like doing it more manually with a spreadsheet because I feel like I’m more invested in it. Because I have to put it in myself, I keep better tabs on it and feel like I better stick to my goals. Here’s how I budget:

Get a spreadsheet

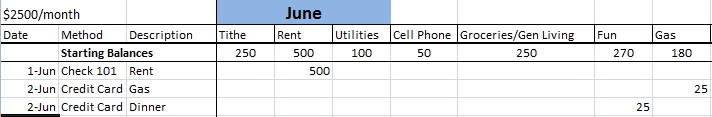

Hopefully you’ll have access to a computer (I assume you do if you’re reading this article) and a spreadsheet tool. It can be Microsoft Excel, Apple Numbers or something more modern like a GoogleSheets. I have a tab at the bottom for each month of the year.

Understand the basics

To budget, the first thing you need to have a good grasp on is how much money you’re earning. Surprisingly, a lot of folks don’t have a good understanding of how much they make, and if you don’t know how much you make, you can’t plan your spending and savings for the month!

So, assuming you earn a salary, go ahead and write that number down. I only account for what actually hits my bank account, and exclude taxes, insurance and any Employee Stock purchase plan contributions or retirement. Assuming you get paid twice a month (which is common), go ahead and multiply that by 2, that’s the number you’ll work with! If you’re not salary and your pay varies, I recommend getting a good base line amount for what you can reasonably except. Then, if it’s more or less, you can adjust as needed.

Also go ahead and figure out your required expenses, whether it’s rent/mortgage, cell phone, car insurance, debt payments and write those down.

On your spreadsheet you got in step 1, list your income up at the top, that’ll be the big number you have to work with, either spend or save it. Go ahead and have categories or ‘buckets’ for your required expenses. Highlight them in red if you’d like, so you know they’re required.

Set your savings goals

Now that you know more of what you’re working with (income – required expenses), you’ve got some money to either save or spend. I like to set savings goals first, otherwise your spending will take it all up! Depending on your savings goals, it could be a lot or a little. I would also include things like: extra debt payments, money invested in the stock market or money moved into savings accounts.

Whether it’s a percentage goal (‘I want to save 20%’) or a number goal (‘I want to save $200/month), set it. I personally set my savings goals quite aggressively, and even if I don’t hit them each month, at least I’m getting (hopefully) close.

Whatever your goal, put it on the spreadsheet as a column.

Spending

Ah, done with the boring stuff like bills or savings and onto the fun stuff – spending. Do some quick math and figure out what you have left. This is called zero-based budgeting, meaning I account for every dollar that I bring in. I either spend it or save it.

Now, spending also in my method includes groceries, food and eating out. I do have different categories; general living and fun.

Day-to-Day maintenance

So, in my spreadsheet, I have my total (income) and then columns for each category with a dollar amount. Those dollar amounts add up to the income. Whenever I spend the money, every few days I’ll open my budget and record the items in rows. I say the date that I spent it, how (ie which credit card I used) and the amount of the purchase or transaction under the column that it belongs to. At the bottom of the spreadsheet I have a formula to tell me how much I have left in that category. If I go over (ie negative) in one category, I force myself to spend less in another.

I probably edit my spreadsheet every other day, but that’s probably a little aggressive and I could stand to just do it weekly. I keep tabs on it and make sure I end the month with every category being zero. If I have leftovers that I didn’t spend, I’ll either put it in savings/investing or roll it into next months spending.

Having a budget isn’t a ton of work or difficult to setup! I actually have my template that I personally use for free download. Hopefully that explains it for you and gives you step by step how to budget! Best of luck with yours and your personal finances!

Need more help? Check out our Personal Finance 101 guide to get you on the right path.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.