The world moves fast and not all investments pan out like you think they should! Investing or holding (or hodling!) crypto has always been risky, and over the past 2 weeks we saw the unfortunate downside of investing when things get ugly. I’m actually not talking about how bitcoin amongst other cryptocurrencies has been on quite the downward slide (bitcoin in the $16,000 range as of the time of writing…down from $69,000 a year ago). I’ve actually been ok(ish) with this decrease and have continued to buy in a little more here and there are my budget allows. As I’ve mentioned in previous posts, I think long-term bitcoin (really only bitcoin IMO but what do I know) will be a great store of value, but also I’ve got like a few hundred dollars in it – I know how risky it is.

What I’m here to discuss today is even worse than just losing some money – I’m here to talk about losing all the money – i.e. an investment going to $0. Over the past 2 weeks, we saw the collapse of one of the major crypto exchanges, FTX. I personally didn’t have any money with FTX (I buy/sell with Coinbase) but I did have money with a company that they may or may not have acquired (crypto has been a bit shady as of late…or just moving really fast) by FTX, BlockFi.

I’ve actually been invested with BlockFi for coming up on a year or so, and had nothing but good things to say about it. As I normally do with this blog, I waited a few months of investing in it myself before writing about it. In February of this year I did write about it and called out how risky it was.

So, now that BlockFi might be going bankrupt and I’ll have potentially lost all my money, I thought I’d do a bit of a look back and talk about what I’ve learned and how I’m feeling!

What happened

FTX, a major crypto exchange started collapsing about 2 weeks ago. There are all sorts of ideas/talk about what actually happened, but it has turned out that the founder/CEO Sam Bankman-Fried was what looks like committing fraud – using company money for his own personal or his insider friend group’s benefit. What’s interested is that earlier this year when crypto was falling, SBF (as he’s known) stepped in and bought a lot of smaller companies that were running the risk of going under. SBF looked like a hero, one who had managed his company well enough that he could lean in and help others. This turned out to be a bit of a sham, and FTX hit the ground pretty quickly.

As I mentioned, I didn’t have any money with FTX, and was reading the news thinking to myself, “ouch that’s a bummer”. What I failed to remember because honestly it had been a while and there had been very little talk about it but FTX had in some way shape or form invested/bought BlockFi (article from July 2022). So I should have realized “oh snap if the parent company FTX is going under maybe I should consider pulling my money out of BlockFi”, but I didn’t and instead of November 11th woke up to this email,

“BlockFi is not able to operate business as usual. We have limited platform activity, including pausing client withdrawals as allowed under our Terms…” (the email went on but that was the gist of it). Ouch.

So there are plenty of news articles and Twitter (or wait is Twitter still a thing?) out there in which you can learn all sorts of the ways SBF misspent client money or why it may have happened, or how it might unfold moving forward but my TLDR is that SBF on behalf of FTX mismanaged client money. What BlockFi was doing was paying a return (‘yield’) on crypto ‘loans’ so they were taking my Bitcoin and lending it out to others, charging a interest rate and then paying me off the spread (so they made a little money) for lending my bitcoin. In my original blog post I wrote about how it wasn’t completely crystal clear how / where they were lending the money but it turns out to have not been as stable as we all had hoped. FTX was doing some shady stuff with their money and BlockFi had money with FTX, was invested in by FTX, some way involved (hopefully we’ll learn more) but when the bank run happened FTX fell and so did BlockFi – they didn’t have enough crypto on hand to pay people out!

How I’m feeling

Hindsight is always 20/20 and it’s kindof easy to look back and be like “yup I saw all the signs”. I literally remember thinking ‘wait so BlockFi pays me 8-9% on my stablecoins (i.e. should be equivalent with the US dollar) and they’re able to do that because they lend that money out to other investors at >10%?” Taking a step back now that feels like a major red flag. Interest rates on personal loans were lower than that, so in reality whoever was borrowing was probably quite risky. In some ways this is what a bank does, although being more heavily regulated and having FDIC insurance can actually be a good thing.

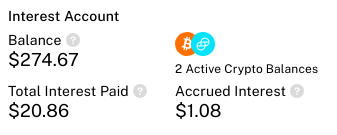

I have at the time of writing $270 with BlockFi. So, even if I lose all of that, it’s thankfully not the end of the world for me, but I know that there are lots of other investors that put in a lot more than me. I risked that money for what was promised to be a nice return – 5ish% on my bitcoin and 8-9% on my stablecoins. To date I’ve ‘earned’ $20 in interest. So, grand scheme of things I’m not too sad. I knew this was a risk all along and knew that it could go to $0. I just didn’t think I would have been right!

On the other hand, my first rule of investing is ‘try not to lose money’ (although I’ve done plenty of that in the stock market) and feel stupid for taking on so much risk. I should have had a strategy in place of slowly withdrawing my gains over time and instead I was so enthralled with the returns! In that regard I’m pretty bummed and hate that I lost it! (Although I suppose to be fair things might turn around for BlockFi and I may have not lost it all).

How I approached risk

‘More risk, more reward’ is an old saying that’s helped me think about investing. I’ve learned a lot about risk mitigation – i.e. taking an amount of risk that is appropriate for me, my situation and my risk tolerance. I’ve got only a few hundred dollars in crypto right now and I’m putting in like $25/month. I appreciate how risky it is. Within my crypto portfolio, I only had about 1/3 of it in BlockFi. I knew that BlockFi was taking a risk with a risky asset. A 9% return on my stablecoins is pretty incredible when banks were paying <1% interest rates (although funny how the times change and now my high yield savings account bank is paying nearly 3%). I took a risk and lost, but that’s how it goes sometimes.

What I’d do moving forward

So I’m holding my breath a little about getting some or all of my money back from BlockFi, but not holding it for very long. I’m coming to terms with the fact that I’ll probably not get that money back. This however won’t be the last investment opportunity that proves too good to be true in the future so my question for myself is, ‘what will I do next go round?’

Firstly, and this lesson isn’t specifically tied to BlockFi but there’s a common phrase in crypto that says “not your keys not your crypto”. Basically what it means is that you’ve got crypto on exchanges (i.e. Coinbase, FTX, BlockFi, Kraken, Binance etc), it’s not really your money in the sense that sure when you login you’ll see your balance but you don’t truthfully know what they are doing with your money. You just hope and pray that if/when you choose to pull your money out that they’ll have the cash to pay out out. For many FTX users this wasn’t the case. I fully realize that with BlockFi they were putting my money to work, but I did realize I had about 2/3 of my crypto just sitting on Coinbase. So over the weekend I got myself a ‘hot wallet’, i.e. a crypto wallet that I own but that’s connected to the internet. I could have gotten a ‘cold wallet’ which is a like a USB thumb drive that is not connected to the internet. So in theory a hot wallet is still risky if I got hacked but right now I’m much more worried about exchanges taking my money instead of hackers.

In a way this is with my trend of mitigating risks and is something I should have done long ago. It costs very little to do this and is much safer this way.

The second lesson I’ll remember is, ‘if it’s too good to be true, it probably is”. This phrase has proven valuable so many times in my life and I bet in yours too. In hindsight how did I believe a magic internet company was lending out magic internet money and paying me real fat returns on my real money? I suppose to be fair I knew I was taking a big risk! I think next time I won’t stop myself from taking big risks with small amounts of money, but I will try to do a better job of slowly pulling my profits out. In a sense a big risk is like gambling – and if you’re up at a casino it’s best to 100% walk away, or slowly start taking away your winnings to the point where you are playing with the houses’ money. I will try to do better with that next time!

TLDR

A big risk I took with a small amount of money went bust. I knew it was a big risk which is why I didn’t put much money in (which I’m thankful for!) but it still sucks. Moving forward I’ll continue to try to mitigate risks while still taking risks, but also if I’m in a situation where the risk is so big it feels like I’m gambling, I’ll do a better job pulling my profits off the table!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.