2020 and 2021 was a pretty wild time for many reasons, including in the financial markets; particularly in crypto. Bitcoin and virtually all over cryptocurrencies were increasing in value like crazy and everyone seemed to be talking about crypto. It was during this time that I got sucked in and got caught up in the craze. I do always like pointing out my first bitcoin article from 2013 when it was $250/coin and I said “nah not for me” but hey I think I made the right call given the information that I had at hand at that time so I’m not too worried about it.

I did start buying crypto and as part of the craze, I thought it would be a great idea to loan my crypto out to other people and that collecting interest was a great financial decision. The company was called BlockFi and the idea seemed simple enough – they were pretending to be a bank…you put your crypto in and you earned interest on your balance. I even dug pretty far into it – essentially they were loaning your crypto out and people would use it for a variety of purposes. It seemed a bit sketch to me but hey this was 2021 and crazy things were happening everywhere! I really honed in on the ability to earn interest on stablecoins – coins that were pegged 1:1 to the USD. At one time they were paying 9% interest…when banks even the high yield accounts, were paying like 1%. That made sense to me – someone would borrow stablecoins to buy more other crypto and they would be willing to take a loan and pay 9+%.

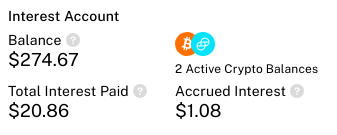

At the peak I had like $700 in the account. I knew it was risky and took the risk for a high reward!

Mid 2022 – Bankrupt

You can go back and read my full post but basically in the wake of FTX (a major cryptocurrency exchange and power broker in the space) going bankrupt, many other crypto related firms went bust too – including BlockFi. Looking back I feel like there were a few days I kind of foresaw what was going on and probably could have pulled my money real quick had I been thinking but alas! Hindsight is always 20/20.

I ended up thinking my $700 was lost.

An early screenshot from my lending with BlockFi!

2023 – Bankruptcy Court

The bankruptcy lawyers were all over this and I would get periodic emails and mailings from them. I opted in to the joint lawsuit as a creditor and looking back it was pretty easy. I didn’t pay anything out of pocket and it took about a year for things to get resolved. The law firm appeared to do a good job and over time I was encouraged when I saw emails saying “proposed settlement” and that the settlement was more than $0. Turns out BlockFi (and FTX for that matter) had money in the bank and assets that could be recovered!

Early 2024 – Recovery

I will say during this time there were plenty of email type scams – the bankruptcy lawyers did warn of this – but thankfully I ignored those. In early 2024 I was notified that I could choose to settle my claims – which I was happy to do so – I had no interest in pursuing further for my $700 that I lost – and then I chose my payment method – Venmo or Zelle. Right? How cool is that – digital payments!

It then took about 6 weeks but sure enough a week or so ago I got a Zelle for $136. So it was about a 20% recovery rate – I’m sure it was lower due to having to pay the lawyers but I had written that $700 off so all in all I’m happy(ish).

If you’ve been following bitcoin you’ll know that in the past few months it’s gone from $40,000 to $70,000 (lol we’re back!!!!) so part of me wishes I got my bitcoin back in bitcoin but that’s not how this works 🙂 and I’m grateful for that payment! To be honest now I need to figure out the tax piece as well – I’ll probably run that by my CPA. I imagine what’ll happen it I’ll deduct the $136 from the $700 loss and then deduct the rest from my taxes. We’ll see!

Summary

I’m glad I didn’t put too much money in. I recognized it was a risky investment and am glad I limited my risk. I’m also glad I got something back – something is better than nothing! Although if possible next time I think I would like to avoid an investment company I’m invested in going bankrupt 🙂 – it took a long time and I only got 20% back!

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.

Personal Finances are certainly top of mind for many of us. If you're looking to get serious about improving your financial situation, we've got lots of great materials all over this site! Additionally, we realize that there's a lot of noise out there, and so we created PERSONAL FINANCIAL GUIDES focused on topics with all the info you need, and without any of the noise/ads/clickbait.